Unemployment Tax Refund Nj

The first phase includes the simplest returns made by single taxpayers who didnt claim for children or any refundable tax credits. Taxpayers will receive a separate notice if a refund is used to offset debts.

Prepare E File 2020 New Jersey Income Tax Returns Due In 2021

Most taxpayers dont need to file an amended return to claim the exemption.

Unemployment tax refund nj. 1075 on taxable income. Yeah I think because only I had unemployment and spouse didnt but filed a joint return somehow screwed up their system. The 10200 is the amount of income exclusion for single filers notthe amount of the refund.

Most taxpayers dont need to file an amended return to. The first refunds are expected to be made in May and will continue into the summer. 14 on up to 20000 of taxable income.

State Income Tax Range. The Internal Revenue Service reported today that another 15 million taxpayers will receive refunds averaging more than 1600 as it continues to adjust unemployment compensation from previously filed income tax returns. The amount of the refund will vary per person depending on overall income tax bracket and how much earnings came from unemployment benefits.

We do not issue Form 1099-G for pensions or unemployment or family leave insurancefamily leave during unemploymentdisability during unemployment. If your modified AGI is 150000 or more you cant exclude any unemployment compensation. If you are married each spouse receiving unemployment compensation doesnt have to pay tax on unemployment compensation of up to 10200.

I did get the IRS letter btw but not until a week after I got the refund. The legislation excludes only 2020 unemployment benefits from taxes. NJ does not tax UC or the supplement as normal policy but other states may However many of the 10s of millions of taxpayer around the country who recieved unemployment had already filed.

You may also apply online. Workers asked to repay unemployment benefits issued during the Covid pandemic may be getting a refund. All refunds are subject to normal offset rules such as past-due federal tax state income tax state unemployment compensation debts child support spousal support or certain federal nontax debts ie student loans.

Amounts over 10200 for each individual are still taxable. Enter the Social Security number that appears first on your New Jersey Gross Income Tax return and the tax year you wish to view. The amount of the refund will vary per person depending on overall income tax bracket and how much earnings came from unemployment benefits.

However it may take states up to a. Use our Check Your Refund Status tool or call 1-800-323-4400 toll-free within NJ NY PA DE and MD or 609-826-4400 anywhere for our automated. Overpayments Refunds If you receive any Unemployment Insurance benefits to which you are not entitled you will be required to return those benefits.

State Taxes on Unemployment Benefits. The amended forms are online here. If you are facing an unemployment overpayment call LSNJLAWSM Legal Services of New Jerseys statewide toll-free legal hotline at 1-888-LSNJ-LAW 1-888-576-5529.

Joe RaedleGetty Images. In addition the quarterly reports forms NJ-927 and WR-30 must be amended online to reflect any reduction in gross or taxable wages. If our refund still comes on.

Because the change occurred after some people filed their taxes the IRS will take steps in the spring and summer to make the appropriate change to their return which may result in a refund. Although the state of New Jersey does not tax Unemployment Insurance benefits they are subject to federal income taxes. The NJDOL also has the right to pursue collection actions to get the money from you.

To help offset your future tax liability you may voluntarily choose to have 10 of your weekly Unemployment Insurance benefits withheld and sent to. Hotline hours are Monday-Friday 8 am. New Jersey does not tax unemployment compensation.

If benefits were paid to you in error you will receive a notice stating the amount you were overpaid and why you were not entitled to the benefits. The amount of the refund will vary per person depending on overall income tax. 1 People got the normal NJUC and the supplement but had nothing withheld and owed taxes on a.

The New Jersey Unemployment Compensation Law 4321-14f establishes a two-year statute of limitations for refunding any payments even if the payment was remitted in error. Unemployment tax refunds started landing in bank accounts in May and will run through the summer as the IRS processes the returns.

Delayed Tax Filing Deadline For Nj About To Become Law As State Budget Is Getting Crushed Nj Spotlight News

Ny Nj Residents Owed Millions In Unclaimed Irs Refunds Pix11

Irs Correcting Tax Returns Issuing Refunds On Unemployment Income Exclusion Njbia New Jersey Business Industry Association

Income Tax Payments Due On July 15 To Give State Funds Much Needed Boost Nj Spotlight News

Child Tax Credit 2021 Thousands Of N J Families Could Miss Out On 300 Payments Nj Com

New Jersey What Is My State Taxpayer Id And Pin Taxjar Support

New Jersey State Tax Refund Nj State Tax Brackets Taxact Blog

Division Of Unemployment Insurance Federal Income Taxes On Unemployment Insurance Benefits

2021 New Jersey Payroll Tax Rates Abacus Payroll

Business Report Tax Rebates Irs Refunds Health Care Expansion Video Nj Spotlight News

New Jersey Tax Forms 2020 Printable State Nj 1040 Form And Nj 1040 Instructions

Nj To End Temporary Work From Home Tax Rules Nj Spotlight News

.jpg)

Division Of Temporary Disability And Family Leave Insurance Do You Need To Download A 1099 G

Aatrix Nj Wage And Tax Formats

New Jersey Unemployment Tips Hotel Trades Council En

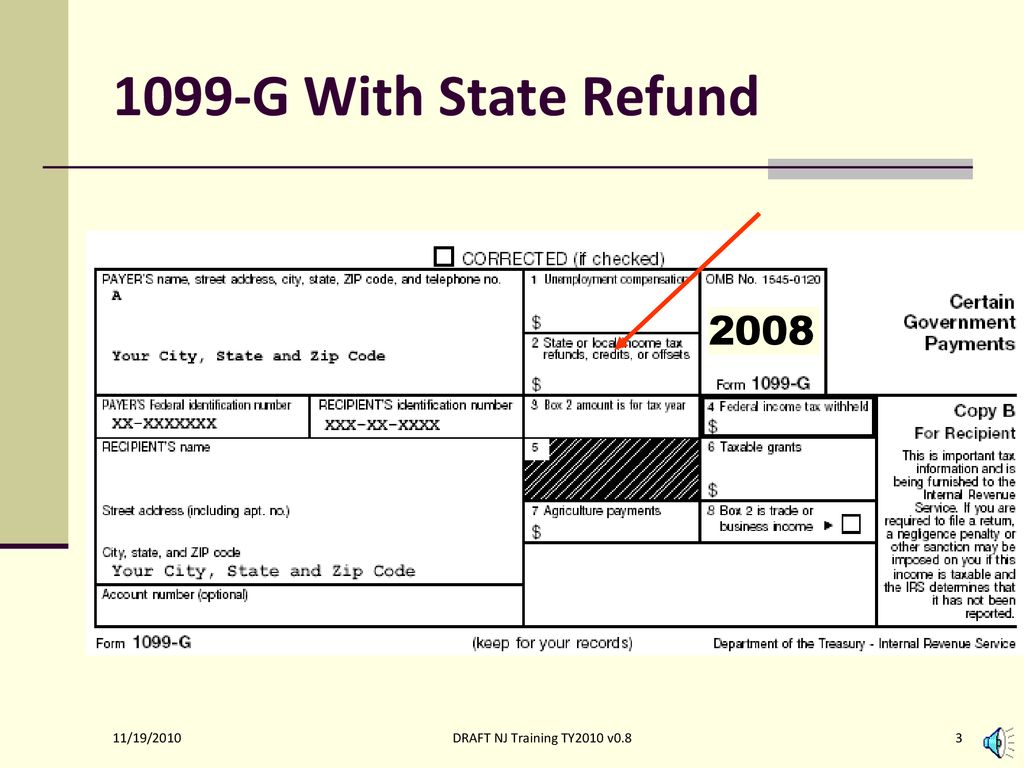

State Income Tax Refund Alimony Ppt Download

High Taxes Mean Less Revenue For Some States Personal Liberty Map Illinois States

Post a Comment for "Unemployment Tax Refund Nj"