Employment Termination Payment Genuine Redundancy

The basic requirement for a genuine redundancy payment is that it must be received by an employee who is dismissed from employment because the employees position is genuinely redundant. The genuine redundancy payment can be made up of two parts for tax purposes a tax free amount calculated based on the period of employment and the remainder amount an ETP life benefit termination amount which itself may comprise a tax free and taxable amount.

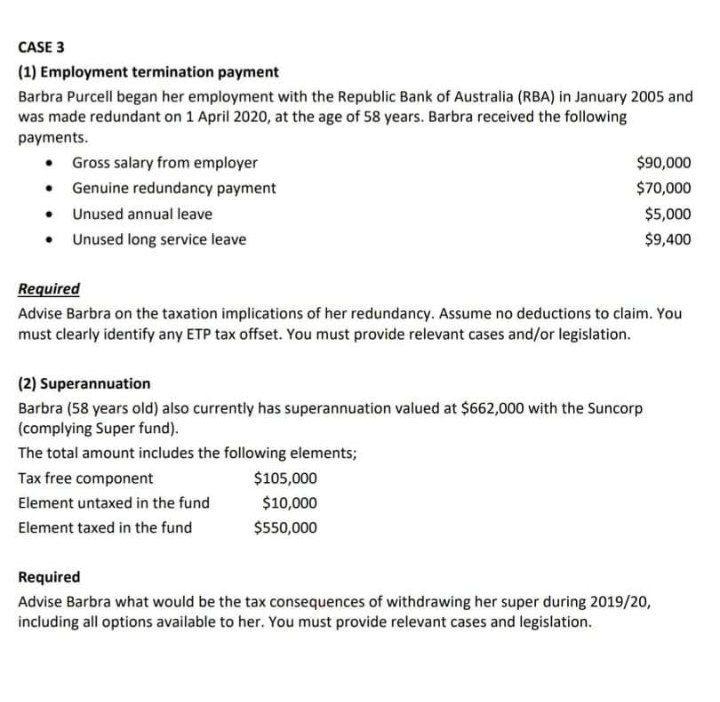

Case 3 1 Employment Termination Payment Barbra Chegg Com

Genuine redundancy payments early retirement scheme payments that exceed the tax-free limit certain payments made after the death of an employee the market value of the transfer of property less any consideration given for the transfer of this property.

Employment termination payment genuine redundancy. However a mere assertion by an employer that the termination of an employees employment results from the redundancy of the employees role or position is not necessarily enough to make out the defence. A payment in lieu of notice can be treated as a genuine redundancy payment if its not expected that you would receive the payment if your employment was voluntarily terminated. Once the terminate Employee action has been selected within a pay run see here for instructions on how to terminate an employee within a pay run you are able to check the ETPRedundancy option that appears in order to be able to process the following ETP payments.

Employers need to be able to demonstrate the payment is a genuine redundancy payment that falls within this definition. There is a strict definition on what qualifies as a redundancy which is defined in section 139 Employment Rights Act 1996. This additional amount is the genuine redundancy payment that may be eligible for tax-free treatment.

However not all redundancy payments are GRPs so care needs to be taken regarding whether the criteria have actually been satisfied. Genuine redundancy payment is a payment received by an employee due to being dismissed because their position no longer exists and is not being replaced4. Type R - eg.

This usually results in a larger termination package than if the client voluntarily resigned or retired. Or finally payments relating purely to termination of employment eg statutory or enhanced redundancy pay. Employment termination payments that meet the definition of genuine redundancy are entitled to concessional tax treatment.

It is worth emphasising that it is the substance of the payment which is relevant not how it is being described in the Settlement Agreement or other correspondence with the employee. HMRC provides the following guidance on their approach to enforcing this and say. A redundancy can be genuine or non-genuine but only a genuine redundancy receives concessional tax treatment.

For a redundancy to be genuine the employer must consult with the employee as per the terms of the applicable award or registered agreement and there must be no other role available within the business or an associated business that the employee could reasonably perform. TR 20092 paragraphs 64 and 327 provide information on when a payment in lieu of notice can be treated as a genuine redundancy payment. Genuine Redundancy Payments GRPs A redundancy payment that meets specific criteria can qualify as a GRP for tax purposes and access tax-free treatment up to a certain calculated limit.

There are four necessary components listed that fall within this requirement. A dismissal is a case of genuine redundancy when. Appointment within 24 hours.

4 For the purposes of the application of the pro- visions of Part 111 to an employee in a private household those provisions except setion 7 shall apply as if the household were a business and the maintenance of the. Most Australians are aware that a case of genuine redundancy is a complete defence to a claim for unfair dismissal. An unfair dismissal application cannot be made if the dismissal was a case of genuine redundancy.

Appointment within 24 hours. The employer no longer requires the persons job to be performed by anyone because of changes in the operational requirements of the employers enterprise AND. The employer has complied with any.

Genuine redundancy early retirement scheme invalidity compensation. The basic requirement for a genuine redundancy payment is that it must be received by an employee who is dismissed from employment because the employees position is genuinely redundant. A redundancy is not genuine if the employer.

This article gives you some detail on redundancy payments. EMPLOYMENT TERMINATION AND REDUNDANCY 5 PAYMENTS 3 Subsection 12 shall not apply to any agreement of a kind mentioned in section 8.

Https Www Payroll Com Au Documents Item 113

Termination Payment Payroller Guide Manual

Section B Payment Details Australian Taxation Office

Consultant Guide For Australia Employment Termination Payment Configuration Ec Payroll Sap Payroll Sap Blogs

Money And Life Helping Clients Navigate A Redundancy Cpd Quiz

Redundancy Termination Letter Lexisnexis

Https Www Health Qld Gov Au Data Assets Pdf File 0033 398913 Qh Imp 267 1 16 Pdf

Processing Employment Termination Payments Type R Type O Payroll Support Au

Employment Termination Payments Atotaxrates Info

5 Record The Final Termination Pay Myob Accountright Myob Help Centre

Https Www Mlc Com Au Content Dam Mlcsecure Adviser Technical Pdf Guide To Etps And Redundancy Pdf

Http Www Gpk Com Au Files Docs Gpk May 2015 Pdf

Https Www Payroll Com Au Documents Item 113

Employment Termination Payments Atotaxrates Info

Http Www Icb Org Au Out Dlid 37723

Title Tax Rules On Redundancy Or Employment Termination Payments

Post a Comment for "Employment Termination Payment Genuine Redundancy"