Employment Tax Evasion Schemes

The IRS says that some of the more common include pyramiding misclassifying workers as independent contractors paying employees in cash filing false payroll tax returns or failing to file payroll tax returns. One of the most commonly used forms of tax evasion schemes employed by businesses is to simply pay their employees in cash.

The fraud that results for willfully failing to file a return is simpler yet.

Employment tax evasion schemes. Employment tax evasion schemes can take a variety of forms. Can I get more information on the Internet. Any arrangement that is marketed in that fashion should be viewed with great suspicion.

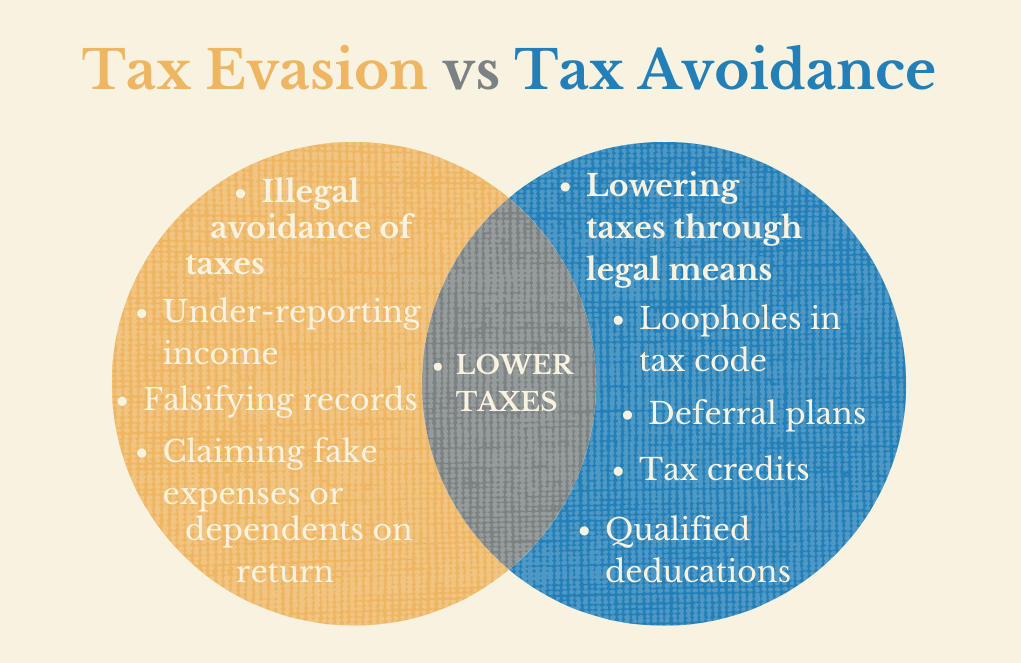

Underreporting of income overstating deductions claiming too many tax credits and hiding money from the government through laundering or illegal accounting schemesWhen we hear the words corporate tax evasion we immediately think of the headline-grabbing corporate scandals of the past. Self-Employment Income Support Scheme. Tax evasion often entails the deliberate misrepresentation of the taxpayers affairs to the tax authorities to reduce the taxpayers tax liability and it includes dishonest tax reporting such as declaring less income profits or gains than the amounts actually earned or overstating deductions.

These employment taxes consist of two separate taxes. Social security tax and Medicare tax. The tools of business and corporate tax evasion are much the same as individual tax payers.

When the employee or employer has a tax liability and he willfully fails to file his income tax return that constitutes an evasion of employment taxes. One of the most commonly used forms of tax evasion schemes employed by businesses is to simply pay their employees in cash. The leasing company collects employment taxes but fails to pay them to the IRS.

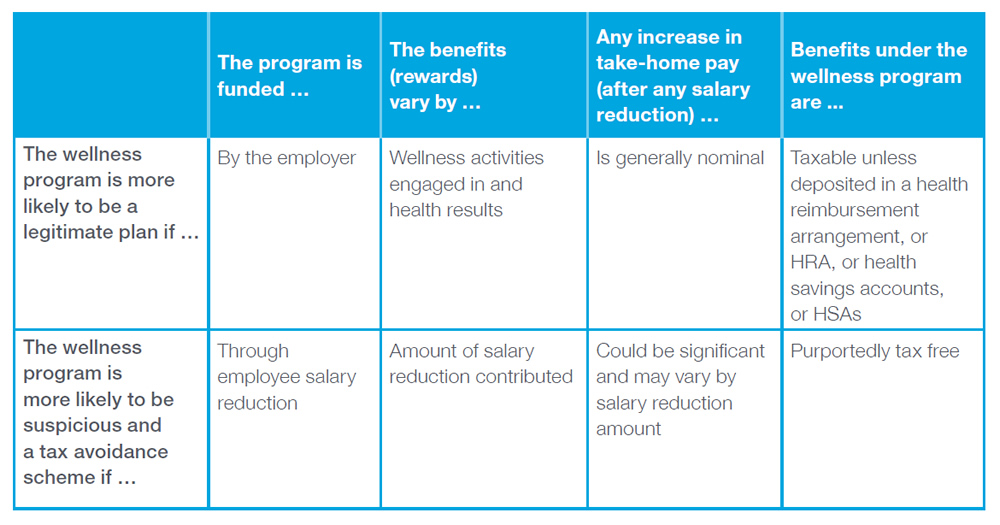

The IRS authorities denounce such tax evasion schemes or double-dipping because they allegedly allow an employee to maintain the same level of pay but reduce the employees taxes. Some of the more widespread techniques of evasion. Statutory Sick Pay support for.

Employment tax evasion schemes can take a variety of forms. Employment Tax Evasion Schemes You Need To Avoid All businesses in the United States which hire employees are legally required to pay employment taxes to the IRS. Employment tax evasion schemes can take many forms.

Career tax evasion plans can httpwwwiowastatetaxreturninfoIowa-Tax-Formshtml take a wide range of types. The IRS is taking a closer look at employers who try to evade employment taxes. Some of the more prevalent methods of evasion include pyramiding employee leasing paying employees in cash filing false payroll tax returns and failing to file payroll tax returns.

If you have been charged or merely at risk of being charged for one of the forgoing crimes we can help. While paying employees in cash is entirely legal it makes detecting wrongdoing difficult for the IRS and defrauds employees of. The Criminal Finances Act 2017 creates two new corporate criminal offences of failure to prevent the facilitation of all forms of tax evasion which change the way in which organisations that facilitate or fail to prevent evasion can.

Contact the Internal Revenue Service at 1-866-775-7474 or e-mail the Tax Shelter Hotline at irstaxshelterhotlineirsgov. By paying their employees either wholly or partially in cash many businesses try to avoid paying the correct amount of employment tax. Tax evasion is an illegal attempt to defeat the imposition of taxes by individuals corporations trusts and others.

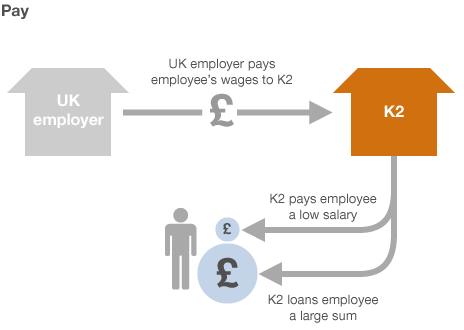

In this multiyear scheme contracting companies subcontracting companies and their employees evaded more than 65 million in employment and income taxes owed to the IRS. HMRC-administered coronavirus relief schemes are the. In this employment tax evasion scheme the business contracts legally with an outside business to manage its payroll.

By paying their employees either wholly or partially in cash many businesses try to avoid paying the correct amount of employment tax. HMRC has never approved these schemes and. The outside business is known as an employee leasing company.

Loan schemes the facts Loan schemes - otherwise known as disguised remuneration schemes - are used to avoid paying Income Tax and National Insurance. Some of the more prevalent methods of evasion include pyramiding employee leasing paying employees in cash filing false payroll tax returns or failing to file payroll tax returns. Victor Hugo Lopez-Diaz 38 was charged by criminal information with one count of conspiring to commit tax evasion and two counts of filing false tax returns.

Tax evasion is not only a privilege of the rich and famous however and employers must be alert to their legal responsibilities regarding their employee actions in this respect.

White Collar Crime Attorney Los Angeles White Collar Crime Lawyer White Collar Crime White Collar Crime

When Is Tax Dodging Illegal Bbc News

Affordable Care Act Aca Compliance Examined The Treasury Inspector General For Tax Administration Tigta Reported That The I Financial Help Irs No Response

The Oecd S Base Erosion And Profit Shifting Beps Plan Was Devised To Mitigate The Estimated About Us100 Billion To Us240 Billion Annually Is Lost Due To An

Https Www Irs Gov Pub Irs News Fs 05 15 Pdf

When Is Tax Dodging Illegal Bbc News

Faqs On The Banning Of Unregulated Deposit Schemes Ordinance 2019 Unregulated Deposit Education

Tax Avoidance Vs Tax Evasion The Big Difference Taxes Taxplan How To Plan Tax Services Business

If As Expected The Republican Bill To Repeal The Affordable Care Act Aca Mirrors The Repeal Measure That President Medicaid Budgeting Healthcare Education

The Times Group Indirect Tax Annuity Income Tax

Small Savings Scheme Kisan Vikas Patra Can Double Your Income In 10 Years The Index View Schemes Patra Income

Tax Avoidance Tax Evasion What S The Difference

Disclosure Of Tax Avoidance Schemes Inheritance Tax Indirect Tax Capital Gains Tax

Watch Out For Fraudulent Health Plan Tax Avoidance Schemes Advisories Aflac

Severe Teacher Shortage Shows States Should Better Fund Schools Center On Budget And Policy Priorities School Fund Budgeting Priorities

9 Income Categories For Your Self Assessment Tax Return Tax Return Self Assessment Income Tax

Post a Comment for "Employment Tax Evasion Schemes"